The Commission is the CEQA lead agency for offshore wind energy projects. The Commission also participates in planning and management initiatives to sustainably develop floating offshore wind in federal waters off the California coast. The Commission, along with other state and federal agencies, collaborates to advance renewable energy goals, including the Biden-Harris administration’s goal to deploy 30 gigawatts of floating offshore wind energy by 2030. Together we are diligently and carefully prioritizing approaches that protect California’s environmental, cultural, and socioeconomic resources while advancing California’s renewable energy goals.

Reports

- Port Readiness Plan July 2023

- Workforce Development Readiness Plan June 2023

- Alternative Port Assessment to Support Offshore Wind Final Assessment Report January 2023

Contact

For inquiries or questions regarding Offshore Wind Energy Development, please contact the Offshore Wind Energy Development team at OffshoreWind.Public@slc.ca.gov.

Offshore Wind Energy in Federal Waters

California offshore wind energy leases: federal Programmatic Environmental Impact Statement

Commission staff continue to work with BOEM on the development of a Programmatic Environmental Impact Statement for the five lease areas in federal waters off the California coast. BOEM is expected to release a draft Programmatic Environmental Impact Statement in 2024. Commission staff signed a Memorandum of Understanding with BOEM staff in July 2024 to facilitate communication and information sharing.

BOEM and the State of California’s cooperative offshore wind energy planning work dates back to 2016 when the BOEM California Intergovernmental Renewable Energy Task Force was created as a partnership of state, local, and federal agencies, as well as tribal governments. That was followed by the development of a tool called the California Offshore Wind Gateway, which can be used to analyze factors such as wind speed and ocean depth to make informed decisions about siting offshore wind energy projects.

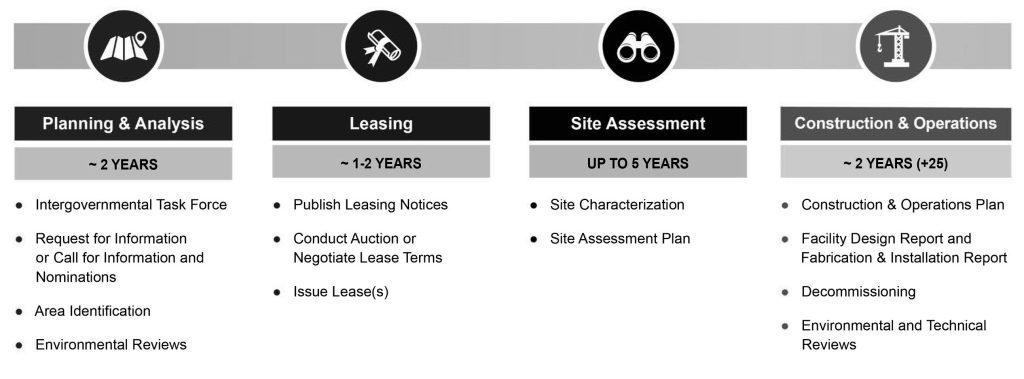

Figure 1. BOEM’s Four-Phase Process for Projects in the Outer Continental Shelf (federal waters). Credit: Bureau of Ocean Energy Management

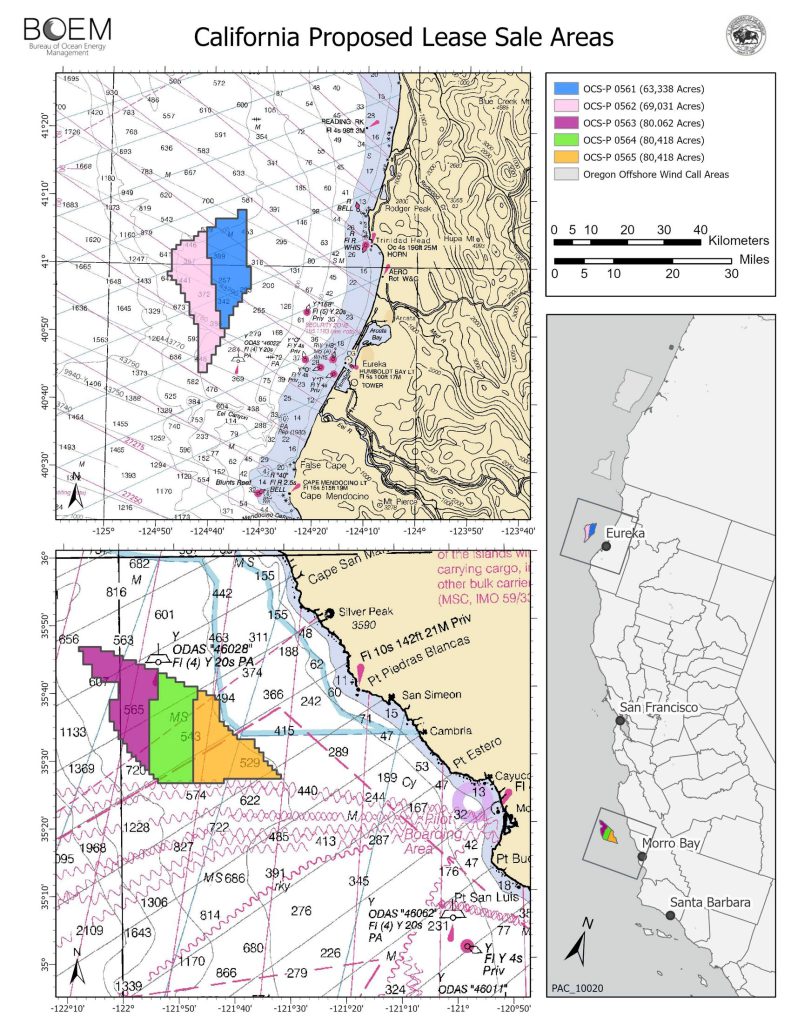

In June 2023, BOEM executed its first-ever leases on the West Coast. These five lease areas have a combined area of 373,268 acres and the potential to generate approximately 4.6 GW of energy (assuming 3 MW / km2).

Table 1. Winners of the 2022 BOEM lease auction with corresponding Wind Energy Area and lease area number

| Wind Energy Area | Lease Area Number | Company |

| Humboldt | OCS-PO561 | RWE Offshore Wind Holdings, LLC |

| Humboldt | OCS-PO562 | California North Floating, LLC |

| Morro Bay | OCS-PO563 | Equinor Wind US, LLC |

| Morro Bay | OCS-PO564 | Golden State Wind, LLC |

| Morro Bay | OCS-PO565 | Invenergy California Offshore, LLC |

The third phase of BOEM’s leasing process, site assessment, involves site characterization and assessment activities to inform how the proposed project will be designed. Developers must submit a site assessment plan within a year of receiving a lease that describes the activities necessary to characterize a lease site. Developers then have up to five years to conduct the site characterization and assessment studies and surveys.

The final phase, the construction and operations phase, involves the lessee submitting a construction and operations plan that describes the project the developer intends to construct and operate. BOEM conducts a National Environmental Policy Act (NEPA) review after it receives a construction and operations plan. Once NEPA is complete, BOEM issues a record of the decision describing its approval, conditional approval, or denial of the project, and any required modification or mitigation. If the project is approved, the developer proceeds with construction and operations after the record of decision is released.

Projects located in federal waters will have component parts (e.g., transmission cables) located in state waters. Developers will need to apply to the Commission for a lease.

Figure 2. The Northern California (Humboldt) and Central California (Morro Bay) Lease Areas. Credit: Bureau of Ocean Energy Management

In addition to a lease from the Commission, developers will need to obtain permits from other agencies. The California Energy Commission’s AB 525 OSW Energy Permitting Roadmap contains a thorough discussion of issues surrounding permitting.

Existing law sets a state policy of supplying 100 percent of our electricity supply with clean energy by 2045. While California has abundant solar resources during daylight hours, demand for electricity increases throughout the day and peaks in the evening, just as the sun goes down and solar energy begins to decline. Offshore winds continue blowing into the evening and nighttime hours, providing a source of renewable energy when solar is unavailable. The SB 100 Joint Agency Report outlines the ways in which the state could meet this goal and the role offshore wind energy can play.

State Offshore Wind Initiatives

AB 525

AB 525 (Chiu, 2021) requires the California Energy Commission, in coordination with relevant state agencies, including the Commission, to establish offshore wind planning goals for 2030 and 2045 and create a strategic plan for offshore wind energy development. Over the past two years, Commission staff has worked closely with the California Energy Commission and other partner agencies on the strategic plan. The California Energy Commission released the strategic plan for public review on January 19, 2024.

In August 2022, the California Energy Commission published the report Offshore Wind Energy Development off the California Coast: Maximum Feasible Capacity and Megawatt Planning Goals for 2030 and 2045, which established energy generation targets of 2 to 5 gigawatts by 2030 and 25 gigawatts by 2045.

The strategic plan includes the following five chapters:

- Identification of sea space

- Economic and workforce developments and identification of port space and infrastructure

- Transmission Planning

- A Permitting Roadmap

- Potential impacts on coastal resources, fisheries, Native American and Indigenous people, national defense, and strategies for addressing potential impacts.

Commission Reports

As part of the AB 525 strategic planning process, the State Lands Commission published three reports that will help inform the strategic plan:

- Alternative Port Assessment to Support Offshore Wind Final Assessment Report

- Port Readiness Plan

- Workforce Development Readiness Plan

Per AB 525, the California Energy Commission, in coordination with relevant state and local agencies, must develop a plan to improve waterfront facilities that could support floating offshore wind energy development. Typically, those activities are categorized as follows:

- Manufacturing and fabrication of component parts, which entails manufacturing wind turbine components.

- Staging and integration, which entails assembly of the component parts into a functional wind turbine that will then be towed to an offshore wind energy area.

- Operations and maintenance, which entails long-term maintenance and repair activities on wind turbines.

Alternative Port Assessment to Support Offshore Wind

In January 2023, the Commission published the Alternative Port Assessment to Support Offshore Wind, which assesses the feasibility of constructing a new port along California’s Central Coast to support the BOEM Morro Bay wind energy area. This report identifies potential alternative port locations between San Francisco and Long Beach and assesses the feasibility of potential port locations to determine the required infrastructure improvements and cost/schedule to develop sites.

Three operations and maintenance sites (Port San Luis, Diablo Canyon, and Morro Bay) were also identified in BOEM’s California Floating Offshore Wind Regional Ports Assessment study and are assessed in further detail in the Port Readiness Plan.

Port Readiness Plan

The Port Readiness Plan assesses the necessary investments in California ports to support offshore wind energy. The Plan considered the potential availability of land and water acreage at each seaport, including competing and current uses; infrastructure feasibility; access to deep water; bridge height restrictions; and potentially impacted natural and cultural resources, including coastal resources, fisheries, and Native American and Indigenous peoples.

The Plan concludes that staging and integration sites are the most critical and that three to five of these sites are needed for California to reach its goal of 25 GW generation by 2045. The Plan, which limited its analysis to port availability within California, found that the need for staging and integration sites can be met by existing ports.

The plan finds that nine to 16 berths are necessary to support operations and maintenance. The Plan concludes that having manufacturing/fabrication sites located in California is not necessarily required to complete projects but having manufacturing/fabrication sites located in the state will maximize economic benefits and job creation.

Workforce Development Readiness Plan

The Workforce Development Readiness Plan assesses workforce needs to meet California’s goals, the current workforce capable of supporting these goals, and assesses the difference between the existing and needed workforce. This report makes five recommendations to meet workforce needs, including having a primary state agency for offshore wind energy economic development, aligning workforce investments with regional port strategies, developing training programs, early engagement with unions, trade organizations, universities, and technical schools, and investing in research and innovation for manufacturing, assembly, staging, and port logistics.

Resources

Other Offshore Wind Projects

The first offshore wind project, Vindeby, was built off the coast of Denmark 1991. Since then, there have been dozens of windfarms built off the coast of Europe, most notably off the coasts of Norway, Scotland, and Denmark. The first offshore wind project in the U.S., Block Island Wind Farm, was operational in 2016. There are now dozens of offshore wind farms in various stages of development on the U.S. East Coast.

It’s important to note that the bathymetry of coastal waters in Europe and the U.S. East Coast significantly differ from that of the U.S. West Coast: on the East Coast, the continental shelf drops off gradually, meaning that depths are, relatively speaking, shallow, even far offshore. On the U.S. West Coast, the continental shelf drops off steeply, meaning that even close to shore, the waters are deep. This has practical implications for offshore wind projects: in the relatively shallow waters of the East Coast and Europe, the foundation of an offshore wind turbine can be affixed directly onto the sea floor. In the deeper waters off California, this is not technically feasible and will require wind turbines affixed to the seafloor by mooring cables. The Hywind Scotland project, launched in 2017, is the first demonstration-scale floating offshore wind farm in the world.

BOEM Studies

- Task Order 1 Port of Coos Bay Port Infrastructure Assessment for Offshore Wind Development

- Task Order 2 California Floating Offshore Wind Regional Ports Assessment

- Task Order 3 California Floating Offshore Wind Regional Ports Feasibility Analysis

For more information, please visit BOEM’s California State Activities website.